Making Tax Digital MTD

Making Tax Digital (MTD) is a key part of the government’s Tax Administration Strategy, aimed to help reduce the tax gap by requiring businesses and individuals to: keep digital records, use software that works with Making Tax Digital and submit updates every quarter, bringing the tax system closer to real-time.

The government strategy supports HMRC’s plans to digitalise the tax system, and it has published various documents for further information and lists the benefits of Making Tax Digital and a digital tax system as:

- making it easier for individuals and businesses to get their tax right

- meaning customers can integrate tax management with a range of business processes through software

- contributing to wider productivity gains for businesses by encouraging digitalisation

This approach will help reduce the amount of tax lost to avoidable errors due to the:

- improved accuracy of digital records

- additional help built into many software products

- digital records being sent directly to HMRC

HMRC recently published evidence of Making Tax Digital reducing the tax gap.

Find out more about how businesses have benefitted first-hand from Making Tax Digital.

For further information visit the Policy paper Overview of Making Tax Digital

[edit] Related articles on Designing Buildings

- Business rates.

- Capital allowances and super deductions.

- Capital gain.

- Capital gains tax.

- Capital allowances.

- Centre for Digital Built Britain.

- Defining the digital twin: seven essential steps.

- Digital engineering.

- Digital Built Britain v BIM.

- Digital information.

- Digital model.

- Digital technology.

- Digital twin.

- Digitalisation.

- Digitisation.

- Digitise.

- How to make the digital revolution a success.

- Industrial buildings allowance (IBA)

- Immersive Hybrid Reality IHR.

- Internet of things.

- Landfill tax.

- PAYE.

- Smart contracts.

- Stamp duty.

- Tariff.

- Tax relief.

- UK digital strategy.

- VAT

Featured articles and news

The context, schemes, standards, roles and relevance of the Building Safety Act.

Retrofit 25 – What's Stopping Us?

Exhibition Opens at The Building Centre.

Types of work to existing buildings

A simple circular economy wiki breakdown with further links.

A threat to the creativity that makes London special.

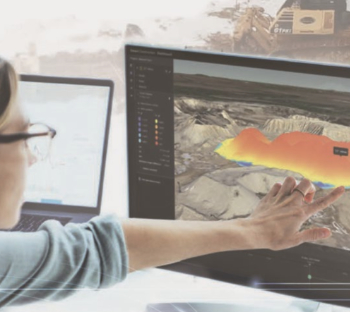

How can digital twins boost profitability within construction?

The smart construction dashboard, as-built data and site changes forming an accurate digital twin.

Unlocking surplus public defence land and more to speed up the delivery of housing.

The Planning and Infrastructure Bill

An outline of the bill with a mix of reactions on potential impacts from IHBC, CIEEM, CIC, ACE and EIC.

Farnborough College Unveils its Half-house for Sustainable Construction Training.

Spring Statement 2025 with reactions from industry

Confirming previously announced funding, and welfare changes amid adjusted growth forecast.

Scottish Government responds to Grenfell report

As fund for unsafe cladding assessments is launched.

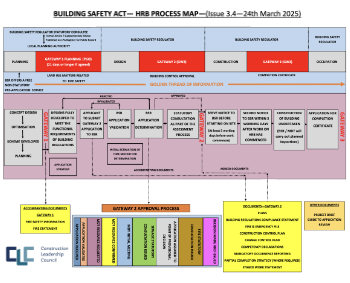

CLC and BSR process map for HRB approvals

One of the initial outputs of their weekly BSR meetings.

Architects Academy at an insulation manufacturing facility

Programme of technical engagement for aspiring designers.

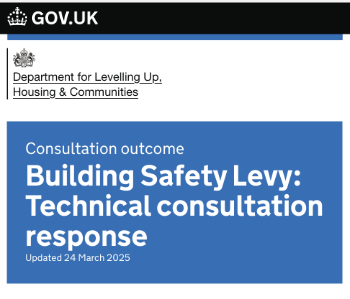

Building Safety Levy technical consultation response

Details of the planned levy now due in 2026.

Great British Energy install solar on school and NHS sites

200 schools and 200 NHS sites to get solar systems, as first project of the newly formed government initiative.

600 million for 60,000 more skilled construction workers

Announced by Treasury ahead of the Spring Statement.

The restoration of the novelist’s birthplace in Eastwood.

Life Critical Fire Safety External Wall System LCFS EWS

Breaking down what is meant by this now often used term.

PAC report on the Remediation of Dangerous Cladding

Recommendations on workforce, transparency, support, insurance, funding, fraud and mismanagement.

New towns, expanded settlements and housing delivery

Modular inquiry asks if new towns and expanded settlements are an effective means of delivering housing.